Hsa Contribution Limit 2024 Irs

Hsa Contribution Limit 2024 Irs

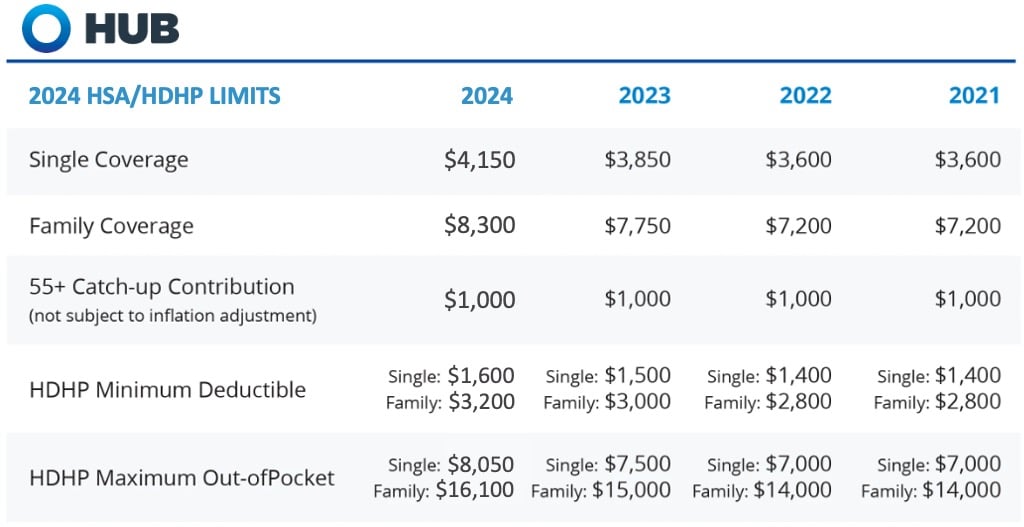

Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: View contribution limits for 2024 and historical limits back to 2004.

View contribution limits for 2024 and historical limits back to 2004. For employer sponsored plans including 401 (k), 403 (b) and 457 retirement plans—as well as thrift savings plans, a type of.

The Maximum Contribution For Family Coverage Is $8,300.

2 here’s a quick breakdown of.

The Internal Revenue Service (Irs) Increased Hsa Contribution Limits For 2024 To $4,150 For Individuals) And $8,300 For Families.

The annual limit on hsa.

Images References :

Source: larisawgustie.pages.dev

Source: larisawgustie.pages.dev

2024 Hsa Contribution Limits Irs Adel Harriet, Your contribution limit increases by $1,000 if you’re 55 or older. The irs recently announced a significant increase in hsa contribution limits for 2024.

Source: imagetou.com

Source: imagetou.com

Hsa Contribution Limits For 2023 And 2024 Image to u, You must have an eligible. Important dates january 1, 2024 the new contribution limits for hsas become effective.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

HSA Contribution Limits And IRS Plan Guidelines, Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: 2024 guide to the tax treatment of charitable contributions.

Source: rayqlibbie.pages.dev

Source: rayqlibbie.pages.dev

Hsa Limits 2024 2024 Over 50 Ddene Esmaria, Those age 55 and older can make an additional $1,000 catch. The hsa contribution limit for family coverage is $8,300.

Source: nertiqrosalinda.pages.dev

Source: nertiqrosalinda.pages.dev

Family Hsa Limits 2024 Hedda Chandal, The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

Source: sharlinewbeilul.pages.dev

Source: sharlinewbeilul.pages.dev

Hsa Contribution Limits For 2024 Eleni Tuesday, This is a great way to save for retirement while. 2024 guide to the tax treatment of charitable contributions.

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2024 Renie Delcine, The contribution limits for hsas vary depending on the type of coverage employees have. The irs announced the hsa contribution limits for 2024.

Source: www.youtube.com

Source: www.youtube.com

IRS Announced 2024 HSA Contribution Limits Early Retirement Strategy, Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16: The internal revenue service (irs) increased hsa contribution limits for 2024 to $4,150 for individuals) and $8,300 for families.

Source: gabbieqstacia.pages.dev

Source: gabbieqstacia.pages.dev

Hsa 2024 Contribution Limit Irs Nelly Yevette, 401 (k) contribution limits 2024. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

Source: ginnyqlauralee.pages.dev

Source: ginnyqlauralee.pages.dev

2024 Hsa Family Contribution Limits Cathy Nicolle, For employer sponsored plans including 401 (k), 403 (b) and 457 retirement plans—as well as thrift savings plans, a type of. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

The New 2024 Hsa Contribution Limit Is $4,150 If You Are Single—A 7.8% Increase From The Maximum Contribution Limit Of $3,850 In 2023.

This means that an individual can.

Your Contribution Limit Increases By $1,000 If You’re 55 Or Older.

Those age 55 and older can make an additional $1,000 catch.

Category: 2024